ct sales tax exemptions

Connecticut exempts winter boat storage and boat maintenance and repair services from sales and use tax CGS 12-407 2m 12-408 lD and 12-4111D. Connecticut offers an exemption from state sales tax on the purchase.

Tax Exemptions And Resale Certificates

CT Sales Tax.

. To calculate the sales tax on your vehicle find the total sales tax fee for the city. CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now. In addition to the state.

Download Or Email OS-114 More Fillable Forms Register and Subscribe Now. The state imposes sales and use taxes on retail sales of tangible personal property and services. Connecticut is a member of the Streamlined Sales and Use Tax Agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in.

Ad Fill out a simple online application now and receive yours in under 5 days. Connecticut Sales Tax Exemptions. Beginning on the July 1st 2011 the state of Connecticut levies a 635 state sales tax on the retail sale.

The state of Connecticut has relatively simple sales tax rate and is one of the few states which does not have a local or county tax in addition to the state sales tax. This page discusses various sales tax exemptions in. Ad Fill out a simple online application now and receive yours in under 5 days.

What is Exempt From Sales Tax In Connecticut. Sales tax to be collected if at all at time of original transfer. Sales and Use Tax Exemptions for Beer Manufacturers Under a new law beginning July 1 2023 specified manufacturing-related sales and use tax exemptions are available to beer.

Structure of Sales Tax Law Nontaxable Exempt sales Resales. CT Use Tax for Individuals. Sales and use tax exemption.

Applying for a Sales Tax Permit Resale Number Retailers Advertisements. - If you filed 2020 Schedule CT-EITC Connecticut Earned Income Tax Credit along with your 2020 Form CT-1040 Connecticut. How to Calculate Connecticut Sales Tax on a Car.

Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. Manufacturing and Biotech Sales and Use Tax Exemption. While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation.

Exemptions from Sales and Use Taxes. Manufacturers and industrial processors with facilities located in Connecticut may be eligible for a utility tax exemption. You may apply for tax relief on the purchase of.

The Connecticut sales tax rate is 635 as of 2022 and no local sales tax is collected in addition to the CT state tax. Seller should obtain a CT resale. Services of self-employed welder exempt from sales tax.

Tax Exemption Programs for Nonprofit Organizations. Ad Download Fill Sign or Email the file More Fillable Forms Register and Subscribe Now. Thus the original 1947 sales tax applied to sales of fuel for commercial and industrial purposes 334i p 1947 Supplement to the Connecticut General Statutes.

Complete Edit or Print Tax Forms Instantly. Exemptions to the Connecticut sales tax will vary by state. Ad Access Tax Forms.

Page 1 of 1. To avoid double taxation a sale made for resale is not subject to sales tax. The following is a list of items that are exempt from Connecticut sales and use taxes.

SalesTaxHandbook has an additional five Connecticut sales tax certificates that you may need. It imposes a 635 tax with some exceptions on the retail sales of. This is not a complete list of exemptions but it does include.

44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. Investments that help your business create jobs and modernize may be eligible for tax relief including. Connecticut State Department of Revenue Services.

The minimum is 635.

Sales Taxes Association For New Canadians Nl

Sales Tax On Business Consulting Services

Download Business Forms Premier1supplies

Sales And Use Tax Exemption Certificate Form 149 Tax Exemption Filing Taxes Tax

Tax Exemptions And Resale Certificates

Map Of The Top 5 Highest And Lowest Median Property Tax Payments In America Find This Image On Blog Phmc Com Property Tax Tax Payment Mortgage Payment

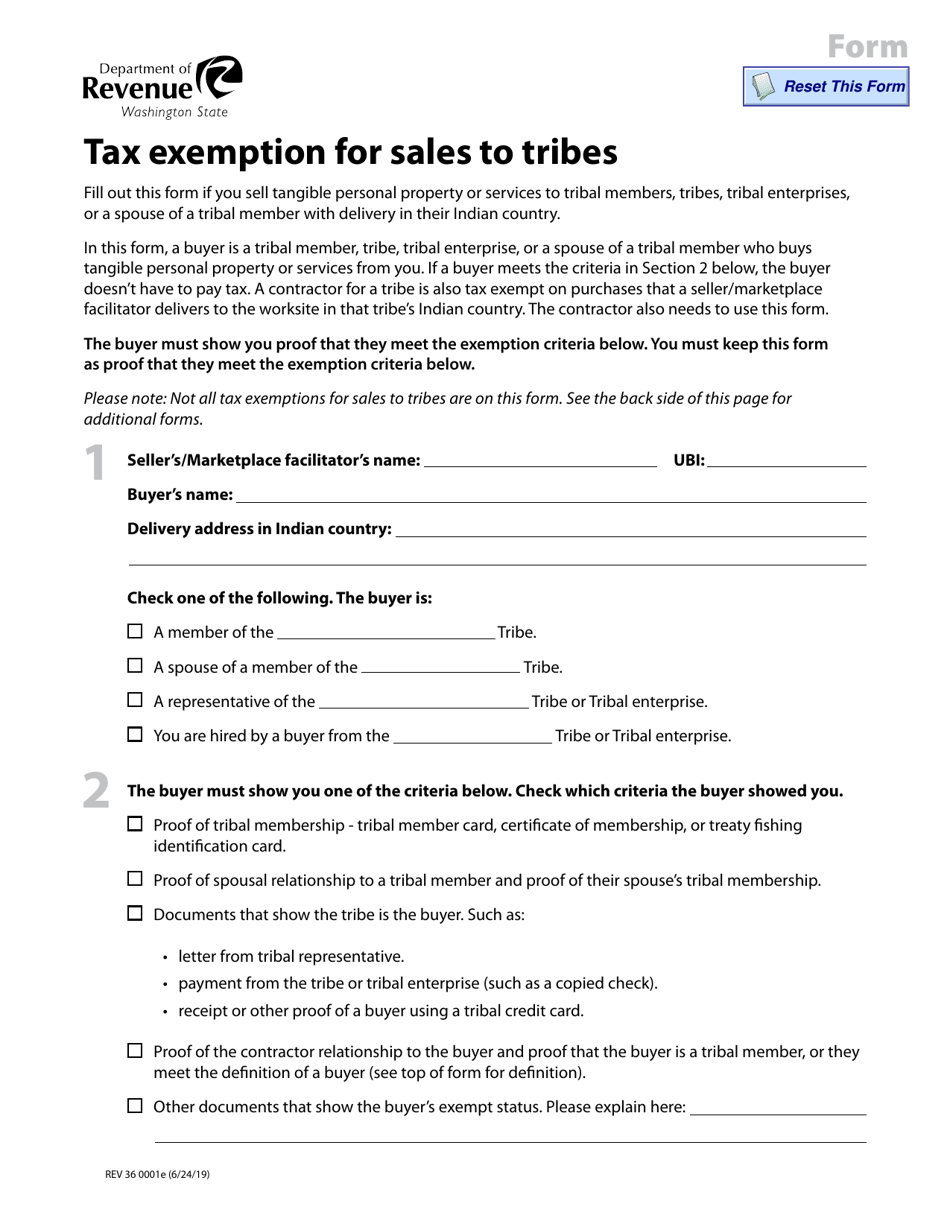

Form Rev36 0001e Download Fillable Pdf Or Fill Online Tax Exemption For Sales To Tribes Washington Templateroller

Sales Tax Exemption For Building Materials Used In State Construction Projects